Understanding The History Of IBM

Connecting the historical analysis of IBM to understand the potential dangers of blockchain, AI, CBDCs, and AI surveillance

Introduction

IBM, or International Business Machines Corporation, is a leading American computer manufacturer with a rich history dating back to 1911. Founded by Thomas J. Watson and often referred to as "Big Blue" due to its iconic logo, IBM has a long legacy of technological innovation and progress.

The company was created through the merger of three successful 19th-century companies: The Tabulating Machine Company, the International Time Recording Company, and the Computing Scale Company of America. Watson joined the company in 1914 and served as CEO for 20 years, transforming it into the multinational giant that it is today.

But IBM's heritage is defined not simply by the sale of its products, or its role is R&D. IBM as a company, has played a crucial role in shaping the technological landscape of the past 110 years and remains a leader in innovation today. However it is important to note that IBM's technology has not always been used for good. During World War II, the company was involved in the war effort on both sides and has a culture of monopolistic practices. I want to explore its history, in order to create a deductive analysis, of IBM's role, within the Blockchain industry.

IBM and the NAZI Party

In 1943, IBM developed the first completely electronic computing machine, the Vacuum Tube Multiplier (VTM). This in turn led to the Automatic Sequence Controlled Calculator, or the “Mark I” in 1944. This was the first device that would be recognized as a modern computer. This computer was used by the U.S Navy to calculate gun trajectories on ships.

While IBM may have played a fundamental part of the allied war effort, so too did they play a fundamental part in Hitler's Germany, it's said, "the trains to the death camps ran on time".

What goes unsaid is why they worked so efficiently, transporting Jews between ghettos and concentration camps on a tight schedule, and were powered by IBM. However, It wasn’t just IBM that worked with the Nazi’s during world war 2, dozens of companies, such as Coca-Cola and Kodak, made clients of Nazi Germany, a few American multinational corporations stand out for going the extra mile.

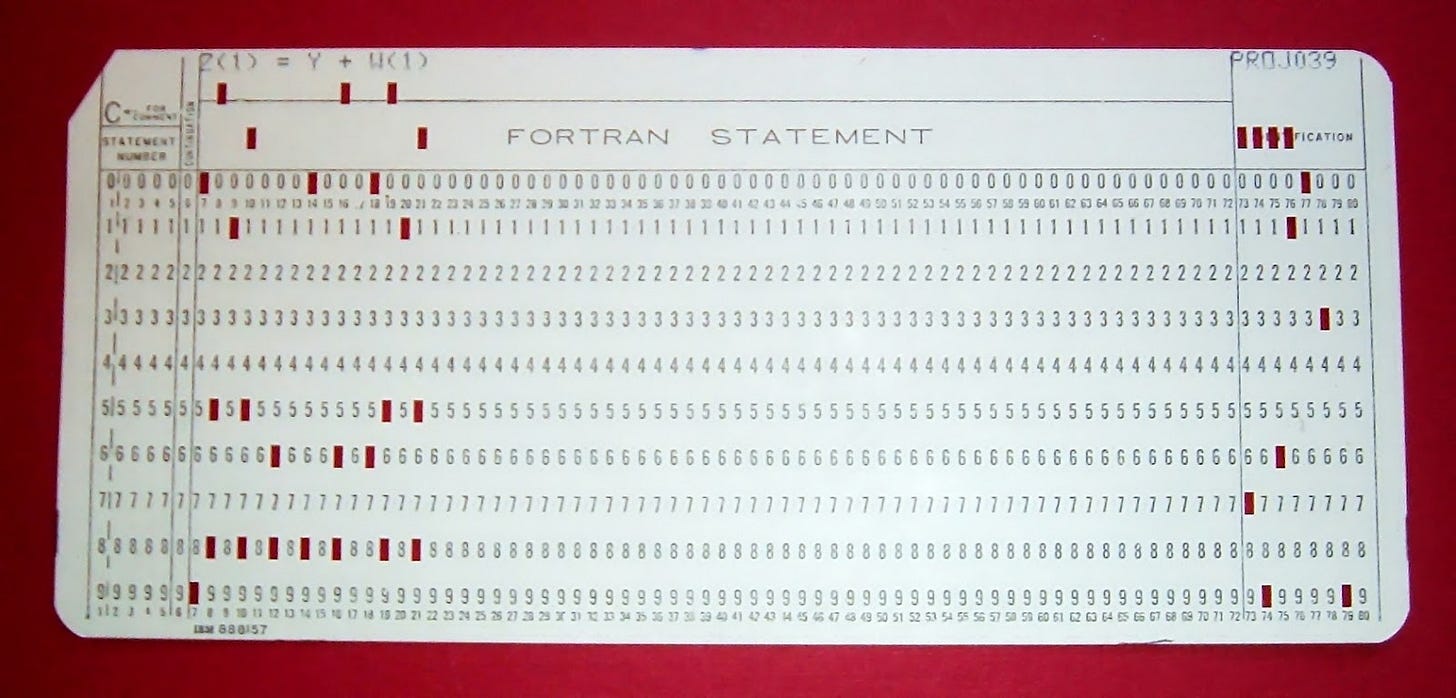

They didn't just sell tools and products; they collaborated with the Nazis in creative ways to help them design and execute the systematic destruction of the Jewish people. IBM Hollerith machine, a tabulating machine that ran on punch cards, was an essential tool for executing the logistical challenges of the Jewish extermination during Hitler's regime in a world before computers.

It was a part of Holocaust history that faded into history — until 15 years ago, when a man named Edwin Black brought it to light. Black is the author of IBM and the Holocaust, a 2001 bestselling book that was written in secrecy and released at the same time that a class-action lawsuit was filed against IBM on behalf of Holocaust survivors.

Black has done the lion's share of scholarship and writing on this subject, including many articles written in the mainstream press, "eventually, every Nazi combat order, bullet and troop movement was tracked on an IBM punch card system." Black went back and forth in the pages of BusinessWeek and the New York Times with reviewers who said that as good as his research was, his accusations were too full of bombast to be taken with full seriousness.

In Hitler's Germany, IBM, was known as the good old "solutions company," and was responsible for the Final Solution itself, there have been tens of thousands of documents, culled together from across Europe, that carefully show how IBM didn't just provide technology to Hitler's Germany — it helped implement and maintain it for whatever purposes the Nazis required.

IBM After World War II

After World War 2, IBM clearly had to work hard to erode it Nazi past. Even during this research of IBM, you have to specifically ask google about its Nazi connection before you will find such information. However, given the nature of the capitalist system and the lobbying efforts of the US’s largest corporations, all of the dozens of US muliti-nationals were given back their Nazi profits in 1947.

After the War IBM got its big breakthrough in the 1960s with its System/360 family of mainframe computers. IBM offered a full range of hardware, software, and service agreements, so that users, as their needs grew, would stay with "Big Blue." Since most software was custom-written by in-house programmers and would run on only one brand of computers, it was expensive to switch brands.

Brushing off clone makers, and facing down a federal antitrust suit, the company sold reputation and security as well as hardware, once again became one of the most admired American corporations of the 1970s and 1980s.

The Static IBM of the 1980s and 1900s

IBM's early dominance of the computer industry was in part due to its strong professional services activities. IBM's advantage in building software for its own computers eventually was seen as monopolistic. As a result, a complex, artificial "arms-length" relationship was created separating IBM's computer business from its service organisations.

IBM struggled in the late 1980s to 1990s – losses in 1993 exceeded $8 billion – as the mainframe corporation failed to adjust quickly enough to the personal computer revolution. Desktop machines had the power needed and were easier for both users and managers than multi-million-dollar mainframes. IBM introduced a popular line of personal computers. Clone makers undersold IBM, while the profits went to chip manufacturers like Intel or software corporations like Microsoft. This led IBM to engage in unfair competition practices, monopolistic behaviour, and attempting to control the entire computer industry.

IBM antitrust Company

At that time, IBM was the leading manufacturer and supplier of computer hardware, software, and services. The company held a dominant position in the mainframe computer market. However, allegations were made that IBM was engaging in anti-competitive practices and abusing its market power.

The case primarily centred around the issue of bundling software with its hardware, specifically the bundling of the operating system called OS/360 with the IBM System/360 mainframe computers. Critics contended that by tying the software to the hardware, IBM prevented customers from purchasing competing software products, thereby limiting competition and stifling innovation in the industry.

As a result, the United States Department of Justice (DOJ) filed an antitrust lawsuit against IBM in 1969, which continued for over a decade. The litigation process involved multiple legal battles, investigations, and hearings. The DOJ accused IBM of engaging in unfair competition practices, monopolistic behaviour, and attempting to control the entire computer industry.

In 1982, while the case was still ongoing, IBM announced a series of significant corporate policy changes known as the "Consent Decree." The Consent Decree aimed to resolve some of the antitrust concerns raised by the DOJ. It included several commitments, such as unbundling software from hardware, licensing certain software interfaces to competitors, and fair pricing practices. These changes were intended to promote competition and open up the market to other companies.

Eventually, in 1984, IBM and the DOJ reached a settlement known as the "Modified Final Judgement." Under this settlement, the remaining antitrust claims were dismissed, and IBM agreed to continue implementing the commitments specified in the Consent Decree.

Modern IBM

IBM has undergone a significant business transformation in recent years, moving away from personal computers (PCs) and towards cloud computing and artificial intelligence (AI). During the dot-com boom, IBM reached a market capitalization of $215 billion, with its peak market value during the dot-com era being $246 billion in 1999 prior to a two-to-one stock split.

Despite the collapse of the dot-com bubble, IBM initially managed to weather the storm, with a 5% decrease in the year following the Nasdaq top, compared to a 59.3% decline for the index as a whole. Since the end of the dot-com bubble, IBM has moved its R&D to big data, cloud computing and most importantly, Blockchain technology

IBM's role in Blockchain Technology

IBM Ranked the top, among blockchain technology providers in 2017, IBM was one of the first to recognize the possibilities that come with blockchain’s distributed ledgers, and made its contribution code to HyperLedger – an open-source effort by Linux Foundation.

IBM also encouraged startup businesses to test run blockchain for free on its cloud, and these efforts are finally bearing fruit.

The demand for Blockchain is steadily increasing and IBM is at the forefront of most large blockchain projects. According to Panos Mourdoukoutas. Professor Mourdoukoutas says, makes IBM a ‘better long-term investment’ compared to using digital currency. In fact, IBM is offering blockchain for financial services, which he believes will translate to more trust for all in a bid to make trust the financial world’s universal currency.

In doing this, IBM intends to bring new simplicity, transparency, and efficiency to all financial transactions, while eliminating the old processes and paperwork with newfound innovation, cooperation, and speed. It’s already happening either way as financial institutions are leading the way forward with IBM’s blockchain for the sector, as they work together to create new solutions, remove long-standing friction, and deliver tangible business outcomes. IBM is currently working on more than 400 blockchain projects across the globe, over and above its lead in universal quantum computing. IBM, is also working with the biggest names in capital investment.

IBM and institutional Finance

In 2017, the tech giant together with its first clients including Daimler AG, JPMorgan Chase, and Samsung, began working to deploy the IBM Q in a bid to explore its applications for science and business, practically. IBM leads in various other promising technologies including Artificial Intelligence (AI), Cloud and Internet Security, making it a better bet in terms of long-term investment.

But what does all this mean and what does it bring to the market?

Donna N. Dillenburger, an IBM fellow, explained this by saying that IBM is creating a system that its clients can be confident in based on secure and verifiable information. However, with IBM’s colourful history and that of the large financial instructions working with, investors and consumers and politicians need to be fully aware of their possible intent and motive.

Connecting The Dots

Let's connect this historical analysis to the potential dangers of blockchain, AI, CBDCs, and AI surveillance:

1. Monopolistic Power:

Given IBM's historical dominance, it serves as a reminder that the consolidation of power in the hands of a single entity can stifle competition and innovation. In the context of blockchain and AI, if a single company or organisation gains excessive control over these technologies, it could pose risks to fair competition and may limit the benefits that these technologies can offer.

2. CBDCs:

Central Bank Digital Currencies (CBDCs) are a form of digital currency issued and regulated by a central bank. While CBDCs have the potential to enhance financial inclusion, efficiency, and security, they also raise concerns about privacy, surveillance, and centralization of control. If not properly designed and implemented, the control over CBDCs could concentrate power in the hands of central authorities, potentially leading to surveillance and control over individuals' financial transactions.

3. AI Surveillance:

As AI becomes more advanced and widely adopted, the potential for AI-powered surveillance systems also increases. If employed without proper safeguards and adequate regulation, AI surveillance has the potential to infringe upon privacy rights, enable mass surveillance, and centralise power in the hands of those controlling the surveillance systems.

To mitigate these potential risks and concerns, it is crucial to ensure transparency, accountability, and appropriate regulation in the development, deployment, and usage of technologies like blockchain, AI, CBDCs, and AI surveillance. Striking a balance between technological progress and safeguarding individual rights and societal well-being is essential for responsible and ethical use of these technologies.

Conclusion

I hope I have explained that blockchain is an evolutionary product, but as I write crypto seems to be taking the same path as many internet firms during the dot-com. 70% of firms will fail and many thousands of retail investors will lose their life-savings.

As such, we must demand of polatications a fully transparent oversight role into the operating practices of firms like IBM. For investors, looking to know the true potential of a given firm or product, take a deep-dive into the firms funding the project and not just the firm itself.

To understand the true potential value of an asset. Understand its consumer use case and the potential value of that market. Analyse their excess to capital and evaluate if they have adequate capital, for economies of scale. But most importantly, understand how a firm is investing their capital, ensure that the capital is being used to improve the underlying technology and infrastructure.